More About Opening Offshore Bank Account

On the various other hand, particular global banks will reject to do business with certain international customers as a result of compliance demands. Financial institutions are needed by the (OECD) and the Globe Trade Organization (WTO) to report info about their global consumers. Each nation follows these laws in its unique way - opening offshore bank account. Particular countries disobey completely.

According to several, having offshore savings account is thought about an exotic device for privacy and also tax obligation evasion, and it is just offered to the extremely wealthy. On the other hand, an overseas savings account can be a beneficial tool for possession security preparation for individuals that have even moderate amounts of money.

They are a beneficial device for persons who regularly obtain and also send out abroad settlements and those who make a multitude of worldwide deals (opening offshore bank account). Below's a summary of a few of the objectives and reasons you would wish to open an offshore account: US Citizens' Offshore Bank Account in a Specific Nation Among the disadvantages of the net is the spread of disinformation.

While specific things have actually modified throughout time, the fact stays that US citizens are enabled to develop accounts outside of the country. An overseas bank account is any monetary account in a nation other than the one in which you are a resident.

Opening Offshore Bank Account Can Be Fun For Anyone

Financial institutions will certainly need to confirm the credibility of any of your papers. In many cases, a notarized copy of specific papers may suffice. On the other hand, other offshore centers choose an apostilles stamp, a qualification mark made use of worldwide. If this holds true, you will certainly require to head to the federal government official licensed to issue this stamp for your state or country.

Offshore Accounts for United States People as well as Its Restrictions These nations are readily available for United States residents if they want to open an offshore bank account: What are the Restrictions? When the (FATCA) was completed as component of the HIRE Act, numerous monetary specialists asserted that the new Act's sole objective was to stop people from opening up overseas accounts.

FATCA did require people to submit documents that confirm the presence of their accounts as well as, sometimes, take down any type of interest earned. Think about that the cumulative equilibrium does not need to stay above $10,000 for an extended duration. Customers need to submit the record if this occurs on a single day throughout the tax obligation year.

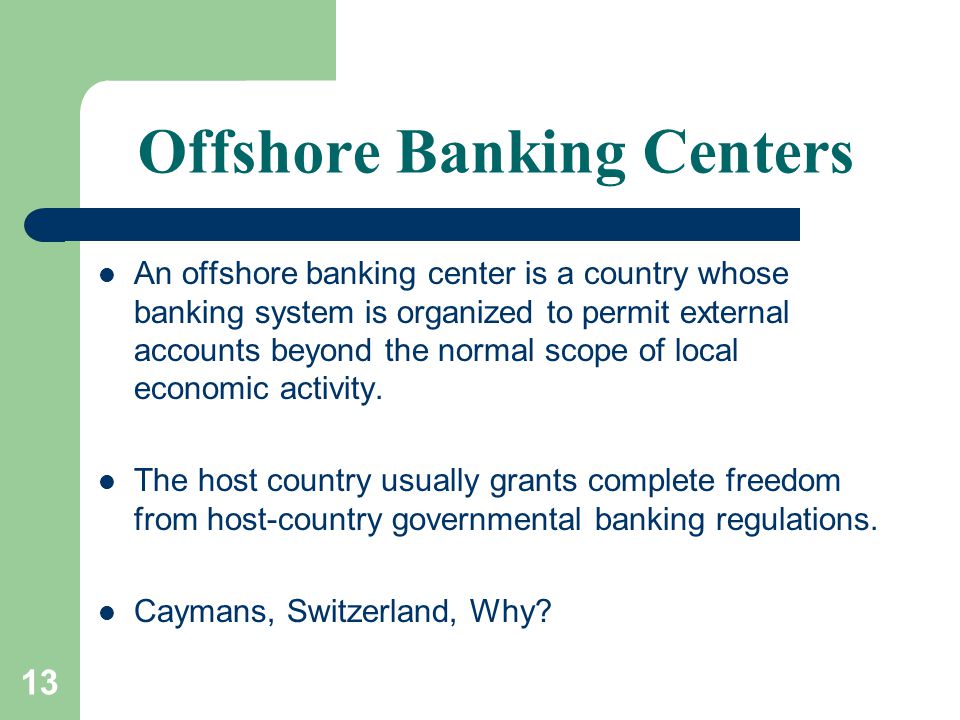

Money maintained in banks past the jurisdiction that produces the cash is called eurocurrency. Neighborhood financial firms and also public authorities have no impact over the activities of overseas units. However, it is crucial to recognize that these entities can not receive funds or offer lendings to people of the nation in which they are presently stationed.

Opening Offshore Bank Account Can Be Fun For Anyone

Thanks to this structure, the business can currently carry out money transfers and currency exchange procedures. Numerous entrepreneurs might contemplate keeping the monetary resources to OBUs to prevent paying taxes and/or to keep their money private. Various other help programs on deals like offshore lending are rarely provided. OBUs may be able to offer more superb passion prices in particular circumstances.

On the various other hand, offshore financial has had an awful rap in the previous few years, many thanks to the upscale and prominent dragging it with the dirt with numerous tax evasion schemes. Offshore accounts, along with offshore banking as an organization, truly aren't unlawful. Countless international execs and travelers, in truth, open overseas accounts once they migrate overseas since they make it possible for sources from throughout the globe.

Benefits of Licensed Offshore Banks To avoid the adverse effects of saving cash at a financial institution in your residence nation, you or your firm can make use of overseas accounts. You are making use of an overseas financial institution in a transparent, highly controlled nation. It is harder for authorities to take possessions held in overseas checking account.

You can safeguard your assets from risks like these by an accredited overseas financial institution. The privacy that features having your accounts held outside your own country is among the benefits. In some nations, such as Switzerland as well as Singapore, bank privacy is a lawful right, and also banks are forbidden from divulging info regarding their account owners or assets other than in extraordinary scenarios, such as a criminal examination.

The 5-Second Trick For Opening Offshore Bank Account

As a migrant, this gets rid of the demand to reclaim tax obligations currently paid and also the inconvenience of resolving your tax obligation returns to ensure you are not paying too much tax obligation. Having an offshore checking account can be beneficial when it pertains to estate preparation. The ability to save and spend funds in an international money for worldwide purchases may be helpful for persons who run worldwide.

Offshore Checking Account Benefits as well as Advantages Offshore accounts make managing monetary responsibilities in several nations as well as areas a lot more available. If you need to send out or get normal overseas repayments and also transfers, they can be handy. Every offshore checking account has its very own set of functions and also advantages; below are a few of one of the most usual: Offshore Banking Disadvantages Regardless of the numerous benefits and advantages that offshore checking account can supply, there are still drawbacks.

reference pop over to this site discover this